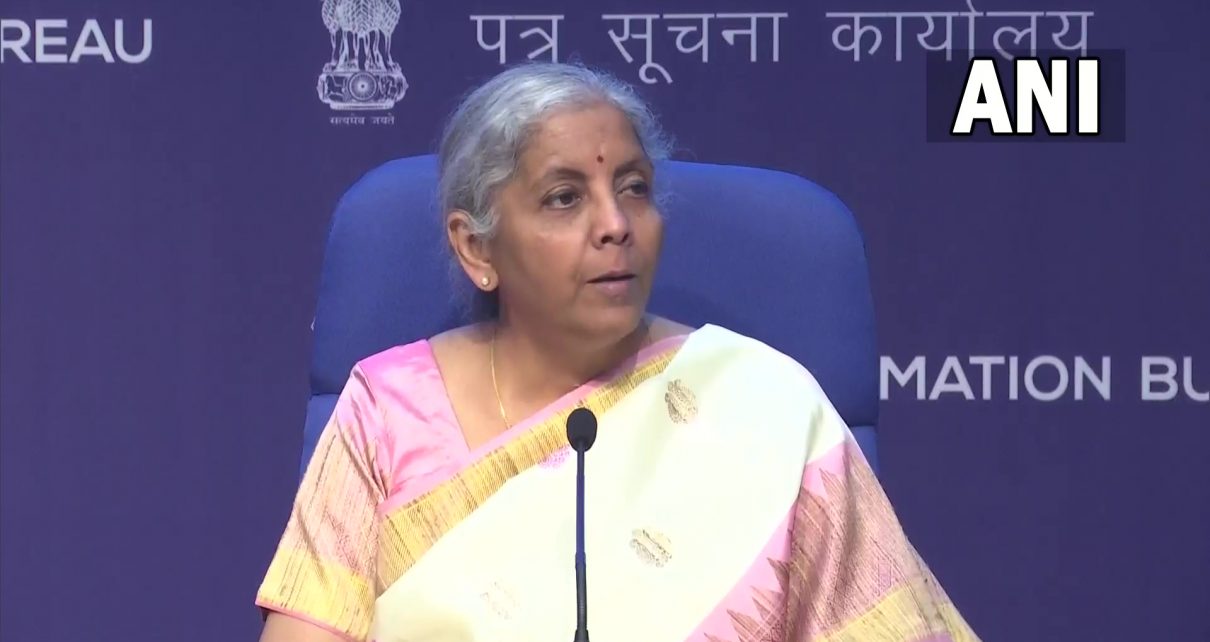

Budget 2022 is a digital budget and the banking sector has received a strong signal as Finance Minister Nirmala Sitharaman announced that the Reserve Bank of India will use blockchain and other technology to bring out a digital currency in the coming financial year 2022-23.

More credit lines for small businesses, the introduction of the central bank digital currency, digital banking push, and amendments to strengthen the bankruptcy law were among key focus areas for the banking sector in this year’s Union Budget.

Here is how different banking and finance sector players have to say post-budget 2022 presentation.

Prashant Kumar – MD & CEO, YES Bank has shared his viewpoint, “Against the backdrop of COVID-19, the Union Budget sets a base for a sustainable long-term growth trajectory. On the investment front, increase in capital expenditure is expected to further reinvigorate the economy and crowd-in private investment. The budget dovetails well with the earlier announced National Infrastructure Pipeline and accordingly provide the necessary counter fiscal push required at this point of time. Overall, the government seems conscious of triggering positive growth impulse with the Union Budget striking the right chords in terms of reviving consumption and boosting investments”

George Alexander Muthoot, MD, Muthoot Finance thought the announcement relating to MSMEs and thrust on digital banking will further go a long way in supporting the economy. He said, “The 2022-23 budget has laid clear emphasis on prioritising economic growth with focus on capital spending to generate growth and employment. The announcement relating to MSMEs and thrust on digital banking will further go a long way in supporting the economy. The MSME sector has been one of the most impacted during the pandemic. Focusing on further supporting the MSME sector and reduce stress in this segment, the Government has widened the ECLGS scheme & revamped CGTMSE (Credit Guarantee Trust for Micro and Small Enterprises).The ECLGS will be extended up to March 2023 and its guarantee cover will be expanded by Rs 50,000 crore to total cover of Rs 5 lakh crore. The CGTMSE scheme will be revamped with required infusion of funds. This will facilitate additional credit of Rs 2 lakh crore for MSMEs and expand employment opportunities. We believe that the NBFC sector will also benefit from the allocation of Rs. 48,000 cr (under the PM Awas Yojana) for affordable housing unveiled by the honourable Finance Minister during the budget announcement. This move will accelerate the credit demand in the economy and positively affect the performance of NBFCs catering to the sector.”

Kavitha Subramanian, Co-Founder, Upstox called it the digital-first budget. She said, “The Hon’ble Finance Minister has presented a digital-first Budget that focuses on quick, holistic, and inclusive economic growth. The focus on start-ups and fintech in this year’s Budget is a fantastic step that will help these sectors grow further.”

“The introduction of 5G and the spread of optical fiber to villages would provide a boost to the Fintech industry. It encourages digital investment platforms like ours to expand their services, resulting in an increase in retail activity in Tier 2-Tier 3 cities and towns. The Central Bank Digital Money (CBDC) will help to enhance the digital economy by making currency management more efficient and less expensive. The capping of surcharge at 15% on Long-Term Capital Gains (LTCG) tax for all listed and unlisted corporations responds to a long-standing demand for new-age businesses,” She added.

Sarosh Amaria, Managing Director, Tata Capital Financial Services Limited said, “The Government has continued its support to MSME sector with measures announced in the Budget like extension of ECLGS scheme and integration of digital portals. Higher allocation towards capital expenditure at Rs. 7.5 lac crores will aid the industry in sustaining recovery after the pandemic.”

Ms. Pallavi Shrivastava – Co-Founder & Director, Progcap said, “The Union Budget 2022 can be rightly termed as ‘The Booster Budget’, which focuses more on revival rather than survival. The budget cascades huge hope to the MSME sector. With the extension of the ECGLS scheme and unification of the Udyam, E-Shram, NCS & Aseem portals, credit facilitation will become easier and the MSME sector will truly thrive through the medium of retail financing startups. We welcome the move by government to boost and encourage startups ecosystem by providing tax benefits and recognizing start-ups as “the growth drivers for India”. Government’s digital push towards promoting and establishing a ‘DigiTech’ India will clearly open the doors for financial inclusion and the fintech revolution.”

Harshad Patil, Chief Investments Officer, Tata AIA Life Insurance has a different view. He said, “The Union Government delivered a pro-growth budget while attempting a modest fiscal consolidation. The Government’s focus was on promoting capital expenditure for triggering higher economic growth multiplier and crowding-in private capex. The Budget provides a sustained impetus for creating world class integrated multi-modal transport and logistics infrastructure while focusing on inclusive development, facilitating energy transition as well as providing a roadmap for financing investments.

There were a host of initiatives such as supporting the MSME sector which has been particularly impacted by the pandemic, creating a digital ecosystem for skilling, increasing the ease of doing business through single window clearances for projects as well as streamlining the government procurement payment processes, promoting the twin objectives of export promotion and import substitution, providing a strong impetus to the Renewal energy and EV ecosystem as well as rationalizing taxes and focusing on smoother tax compliance. The equity markets have welcomed the growth oriented budget as well as the outsized increase in capex provided for.

The Union Budget pegged the fiscal deficit for FY 2021-22 at 6.9% of GDP, a marginal slippage of the earlier budgeted 6.8% and attempted a modest fiscal consolidation at 6.4% of the GDP for FY 2022-23. The gross borrowing stands at an elevated INR 14.95 tn for FY 22-23, considerably above market expectations. The fixed income market would seek further clarity regarding the financing mechanism for the same in the coming days.”

Anirudha Taparia, Joint CEO, IIFL Wealth congratulated the Finance Minister for the holistic budget. He said, “My congratulations to FM Nirmala Sitharaman and the government for delivering a well-rounded and holistic budget that tactfully manages to strike a balance between growth and fiscal profligacy while marching towards achieving the overall goal of becoming an Atmanirbhar Bharat. The overall increase of 35.4% in capital expenditure to Rs. 7.5 lakh crore coupled with the intention of crowding private investment through higher public spending is likely to drive the fledgling recovery that we are currently witnessing. Further, measures to give an impetus to MSMEs and infrastructure spending are likely to have a multiplier effect on the economy, simultaneously boosting employment, production, and consumption. Today, as we stand in the aftermath of the pandemic, what we need are the right booster shots to get the growth flywheel moving while concentrating on human capital augmentation and adequate social sector and healthcare spending. The Union Budget has delivered on all these fronts.”

Rakesh Sharma, MD&CEO, IDBI Bank has a view that the Budget announcements will go a long way in achieving the goal of Atmanirbhar Bharat. He said, “This is a growth oriented, forward looking budget with focus on capital expenditure in the infrastructure sector, particularly in roads, railways and their associated logistics. Coming on the back of nascent economic growth, estimated to be around 9.2% in the current year, and in the midst of the third wave of the pandemic, the Union Budget provides for targeted policy prescriptions for enabling inclusive development, productivity enhancement and financing of investment mainly through PPP model. Keeping in view the prevailing financial strain, especially on small businesses, during the pandemic, the extension of ECLGS till March 2023, and expansion in the guarantee cover of CGTMSE, will indeed be a boon for MSMEs, which have been primary beneficiaries under the scheme. I am sure that the Budget announcements will go a long way in achieving the goal of Atmanirbhar Bharat.”

Prabhtej Bhatia, Co-founder, Falcon, an embedded payments digital startup, which has just emerged from stealth mode welcomes the extension of tax incentives for digital startups by one year. He said, “Falcon will be eagerly looking to see how this space emerges and will be one of the first to integrate with the ecosystem as the new digital currency will bring traceability, affordability, reach and financial literacy across the payments ecosystem. I think the government has given a great push to boosting digital payments in India – both through fiscal measures to augment the infrastructure and through specific measures like launching Digital Banking Units and bringing Post Offices to offer core banking services. This will definitely widen the scale of digital financial infrastructure in the county and also boost the embedded finance space as there will be faster adoption of Fintech solutions from all players targeting the semi-rural and rural parts of the country. Also, this budget has identified the growing importance of Fintech in the economy with several measures such as Fintech courses through world class institutions to train the workforce in India. This will go down as a seminal decision taken by the government in proliferating the Fintech ecosystem in the country for years to come.”

Ajay Srinivasan, Chief Executive – Aditya Birla Capital called it a pro-growth and forward-looking budget. He said, “The Finance Minister has presented a pro-growth and forward-looking budget. It has complemented macro growth with social welfare while being accommodative on fiscal consolidation. The budget has differentiated itself with its focus on the digital economy, startups, and tech-enabled development as well as energy transition and climate action. The capex-heavy budget has reiterated focus on public investment to modernize infrastructure over the medium term. The overall focus is clearly to nurture growth and support economic recovery.”